Your Guide to Contract for Deed Homes in Minnesota

Buying a Home with a Contract for Deed

Imagine being just one step away from owning your dream home, but instead of taking the traditional mortgage route, you choose a different path—one that could be filled with hidden pitfalls or lead you straight to success. This path is known as a contract for deed in MN.

A contract for deed isn't just an alternative to mortgages and leases; it's a unique beast altogether. Picture this: The seller isn't your landlord, and you're certainly not a tenant. While this arrangement can pave the way to owning a home, it doesn't come with the cozy protections of a lease or the robust security of a mortgage.

Many dive into contract for deed in MN agreements without fully grasping the legal intricacies and potential risks. They see an opportunity to bypass the hurdles of traditional financing but often overlook the fine print that could make or break their journey to homeownership.

Understanding the nuances of a contract for deed can transform it from a risky deal into a strategic move. This method has been a game-changer for countless Minnesotans, serving as a crucial bridge to owning a home when traditional financing is out of reach.

Here's what you need to know: While you don't get the same rights as a mortgage holder or tenant, a contract for deed can offer unparalleled flexibility and a chance to improve your financial standing. Embrace this tool with the right knowledge, and you'll not only sidestep potential pitfalls but also position yourself for long-term success.

In essence, a contract for deed can be your secret weapon in the quest for homeownership. Approach it with caution, arm yourself with information, and this little-known secret could lead you directly to the doorstep of your new home.

Work With Professionals

At The Antonov Group at EXP Realty, serving the Twin Cities and surrounding areas, we believe in the power of innovative solutions. Although contract for deed has been one of our key real estate services, our primary goal is to help our clients avoid buying on a contract for deed and find a better alternative. We helped countless clients navigate the complexities of buying a home in MN without traditional financing and oftentimes found less risky and less costly alternatives.

It's a bold move, but with the right guidance, it can be the smartest decision you make.

Ready to unlock the door to your new home? Let us guide you through the process, leveraging our expertise to ensure your success. The journey to homeownership is just a step away, call or text us 612-445-4981 to learn more.

With a decade of experience, we firmly believe that owning a home is far more beneficial than renting. Our team of experienced Realtors is committed to turning your dream of homeownership into reality, no matter your situation. As an award-winning team of real estate professionals serving the Twin Cities and surrounding areas, it is our honor to guide you through the process.

Who is Contract For Deed For?

A Contract for Deed is an alternative financing option that can be particularly suitable for a range of homebuyers who may not fit the traditional mold required by conventional mortgage lenders. This includes any homebuyer who might be slightly outside of the box.

Please NOTE: The majority of home buyers who inquire about contract for deed homes in MN have an option of getting a home loan instead. We found that after speaking to a reputable loan professional, many of the home buyers are eligible for a home loan and don't even know about it. In many cases, our home buyers end up being so close to being able to get a home loan that doing a contract for deed can be avoided. It saves a lot of money and hassles in the long run. We want to save you money and help you avoid making costly mistakes. We would love to help you make better decisions and be your long-term friend in real estate.

Call or text us

612-445-4981 anytime (hassle-free consultation, no obligation).

Buyers with Less-than-Perfect Credit

Individuals who have faced financial hardships, such as bankruptcy, foreclosure, or divorce, or have low credit scores, might find it challenging to secure a mortgage through traditional means. A Contract for Deed can offer a more flexible path to homeownership without the stringent credit requirements of banks.

Self-Employed Individuals

Getting a loan for self-employed homebuyers is always a challenge. Those who are self-employed or work as freelancers often struggle to provide the consistent income history and employment verification required by traditional lenders. A Contract for Deed can be more accommodating to varied income sources and might not require extensive documentation. However, a portfolio loan through a community bank could be a better option than C4D.

Home Buyers with ITIN (With No Credit History)

The biggest misconception that we always hear is that home buyers with ITIN can’t get a home loan and have to use a contract for deed instead. Yes, it is possible to obtain an FHA loan with an ITIN number…and many lenders offer ITIN home loans. This option opens opportunities for homebuyers who may not have a Social Security Number. However, in many cases contract for deed is the only option.

Real Estate Investors

Real estate investors looking to acquire properties without engaging in the lengthy and sometimes uncertain mortgage approval process may opt for a Contract for Deed MN. This can be particularly advantageous for investors focusing on properties that may not initially qualify for a mortgage due to the condition or other factors. Oftentimes, going with a contract for deed in MN is a better option than using a hard money loan but there are many other options available as well.

Buyers Looking for a Short-Term Solution

Individuals who plan to improve their financial standing or credit score within a few years may see a Contract for Deed as a temporary solution. It can serve as a bridge, allowing them to acquire a home now to refinance into a traditional mortgage later. Contract For Deed is one of the best tools to secure an equity position without having to waste money on rent.

Buyers Interested in Non-conventional Properties

Properties that might not qualify for traditional financing due to their condition, type, or other factors (like rural properties) might still be purchasable through a Contract for Deed. A lot of rural sales in Minnesota are sold on a contract for deed. This financing method can offer more flexibility regarding the property types eligible under the agreement. Think about all of the unique homes out there: seasonal homes, dome homes, earth homes, manufactured homes, etc.

Real Estate Market Constraints

Think about a pure seller’s market. In highly competitive real estate markets, we always have an abundance of buyers. In a seller’s market, the pool of buyers is much smaller, requiring home sellers to get creative and offer seller financing to attract a bigger pool of buyers. During the 2010-2014 real estate market, a lot more sellers were willing to hold a contract for deed in MN compared to 2020-2024 market but that may change if interest rates continue climbing.

Buyers Looking for Temporary Options

For those who anticipate a significant improvement in their financial and or legal situation (like receiving an inheritance, going through a divorce, settling a lawsuit, or resolving temporary legal issues), a Contract for Deed can provide a pathway to homeownership in the interim period.

Each situation is different, it's crucial to conduct thorough due diligence, understand all the terms of the C4D, research your options and consider the potential risks and benefits. It is so easy to overlook all of the risks due to the excitement of buying a new home on a contract for deed. Consulting with real estate professionals and legal advisors is highly recommended to ensure that the Contract for Deed in MN that you are looking at aligns with your long-term interests and financial goals.

If you ever have any questions about contract for deed homes in Minnesota feel free to Call or text us 612-445-4981 anytime.

What is a Contract for Deed?

A contract for deed, also known as a land contract or installment sale agreement, is a financing option that allows buyers to purchase a home in MN directly from the seller without going through a traditional mortgage lender. This alternative financing method is particularly beneficial for individuals who may not qualify for a conventional mortgage due to credit issues, unconventional and inconsistent income or other financial constraints.

How Does a Contract for Deed Work?

- Agreement: You and the seller enter into a contract for deed, specifying the purchase price, interest rate, and repayment terms. This contract acts as both a purchase agreement and a financing agreement.

- Down Payment: A down payment is typically required, similar to a traditional home purchase. On average we see sellers ask for 10% down or more.

- Monthly Payments: You make monthly payments directly to the seller, which include principal and interest. The terms are agreed upon in the contract.

- Transfer of Title: The seller retains the deed to the property until the contract is paid in full. Once the final payment is made, the seller transfers the deed to you, making you the legal owner.

Think of it this way: you sign a contract with all of the terms and conditions. Once you fulfill all of the terms of the contract, you get the deed. You get the deed in exchange for fulfilling the contract.

Pro Tip: if you sign a contract for deed with a seller, it is your responsibility to record it at the county. You want to be able to have the right to have equitable interest, use, control, and transfer the property while in a contract for deed. Meaning you want to have the right to live in the property, rent it out, or even sell it. It is important to use the services of a reputable title company and/or attorney to properly record it.

Pros and Cons of Contract for Deed

Pros

- Flexible Financing: Easier qualification compared to traditional mortgages, especially for those with poor credit or inconsistent income.

- Faster Process: Quicker closing process since no bank approval is required.

- Equity Building: Begin building equity from day one as a homeowner.

Cons

- Higher Interest Rates: Interest rates are often higher than conventional mortgage rates.

- Risk of Forfeiture: Missing payments can result in losing the property and all payments made.

- Limited Protection: Buyers may have fewer protections compared to traditional mortgage agreements.

Things to Look Out For

When considering a contract for deed, it's crucial to be aware of potential pitfalls:

- Interest Rates: Ensure you understand the interest rate and how it compares to traditional mortgages.

- Clear Terms: The contract should clearly outline all terms, including the total purchase price, payment schedule, and consequences of default.

- Property Condition: Have the property inspected to avoid unexpected repair costs.

- Title Issues: Verify that the seller has a clear title to the property to avoid future legal issues.

Common Scams

- Predatory Terms: Unfavorable terms that heavily favor the seller.

- Hidden Fees: Unexplained or exorbitant fees hidden in the contract.

- Unclear Ownership: Issues with the property's title that could affect your ownership rights.

Making an Informed Decision

We understand the complexities and risks associated with contracts for deed. Our mission is to help you avoid costly mistakes and guide you toward a secure and beneficial path to homeownership. With access to the best lenders and home financing programs, we are here to ensure you become a homeowner sooner. Call or text us 612-445-4981 to learn more!

Our commitment to long-term relationships means we prioritize your best interests. We offer comprehensive support, whether you're exploring a contract for deed or ready to commit to a traditional purchase. As industry leaders, we take pride in our proven track record and dedication to our clients.

Get in Touch

Whether you're looking to buy a home through a contract for deed or exploring other home buying options, The Antonov Group is here to help. Submit an inquiry today to explore your options and take the first step toward finding your perfect home. It would be our honor to serve you and help you achieve your homeownership dreams!

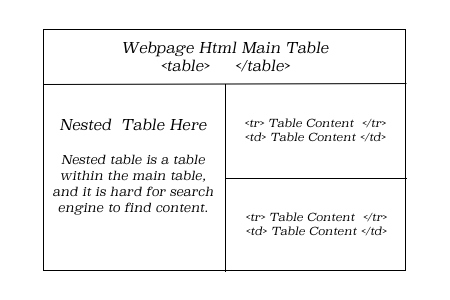

Title Advice:

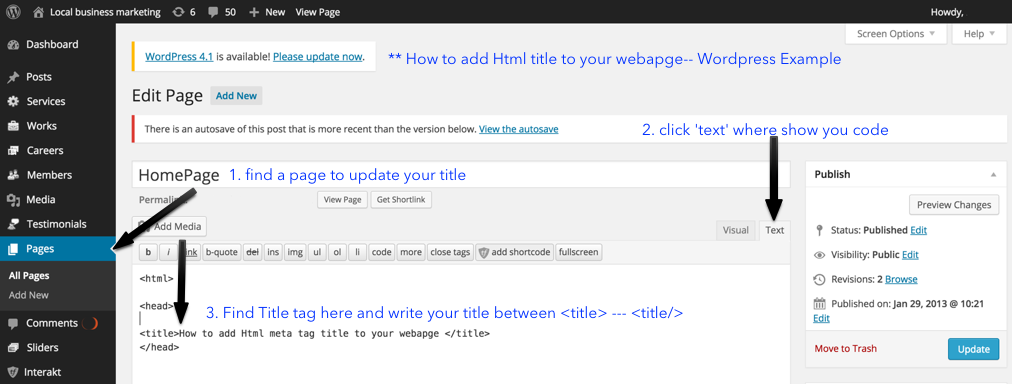

Title Advice: How to add Html Title to your web pages?

How to add Html Title to your web pages?

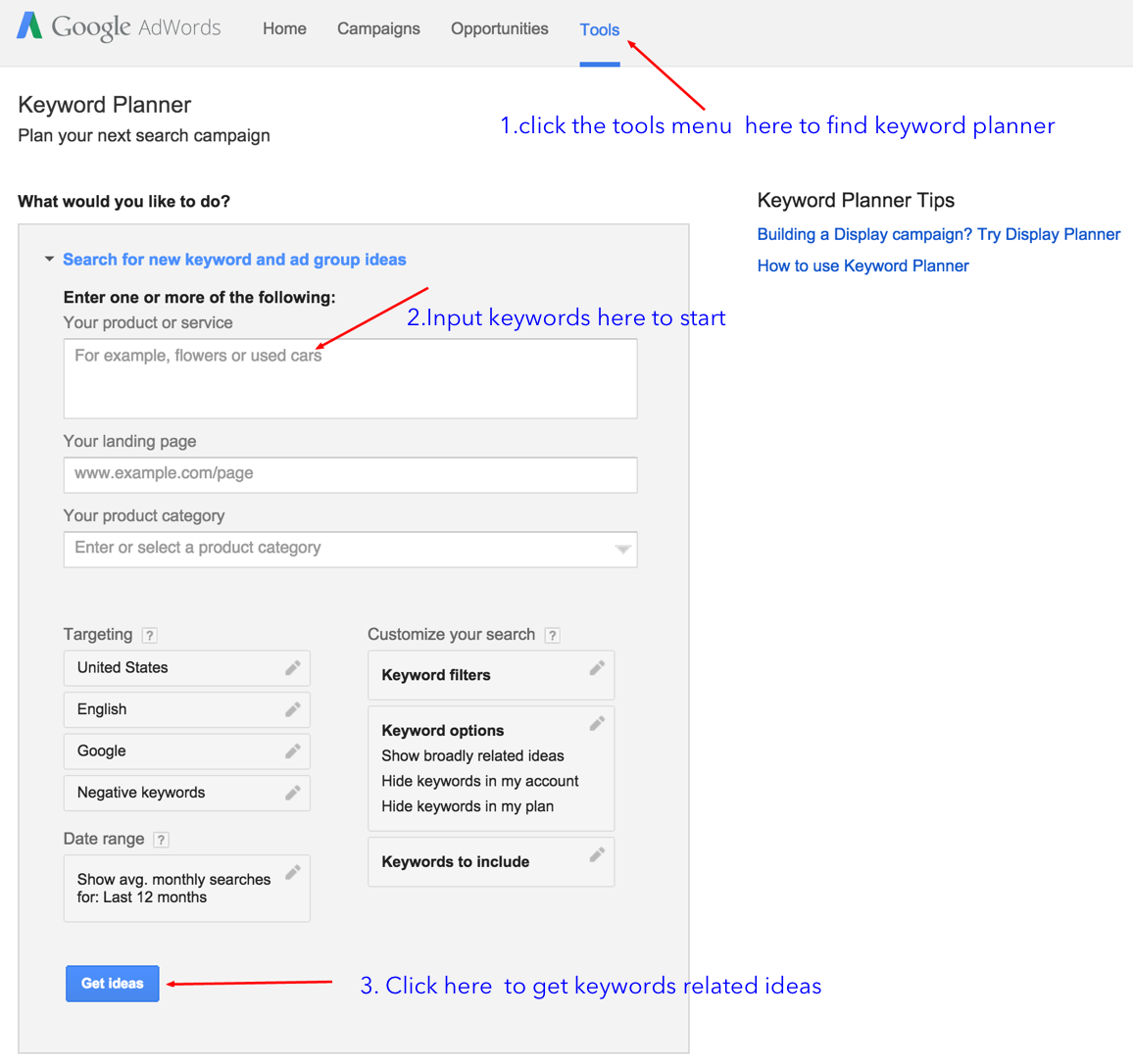

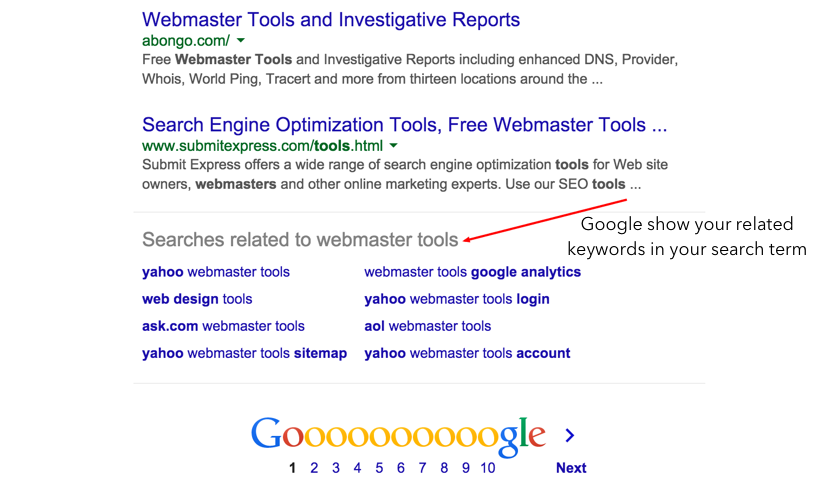

How to research profitable keywords for your Title?

How to research profitable keywords for your Title?

Use Suggested List Of Keywords Tool

Use Suggested List Of Keywords Tool

See your title preview in Google Spider Source Code

See your title preview in Google Spider Source Code Preview Your SEO Title Tool

Preview Your SEO Title Tool

Understand How Google Search Works?

Understand How Google Search Works? Understand How Google Search Works?

Understand How Google Search Works?

Means Perfect, passed

Means Perfect, passed Means Ok, to improved

Means Ok, to improved Means Warning, suggest fix

Means Warning, suggest fix Means Error, take action now

Means Error, take action now

SEO Content

SEO Content

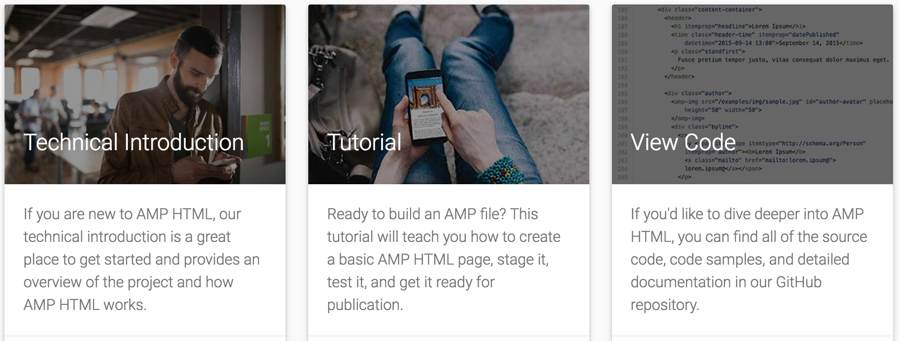

You Don't Have To Be A Designer To

You Don't Have To Be A Designer To  SEO Links

SEO Links

SEO Keywords

SEO Keywords

Usability

Usability

Document

Document

Mobile

Mobile

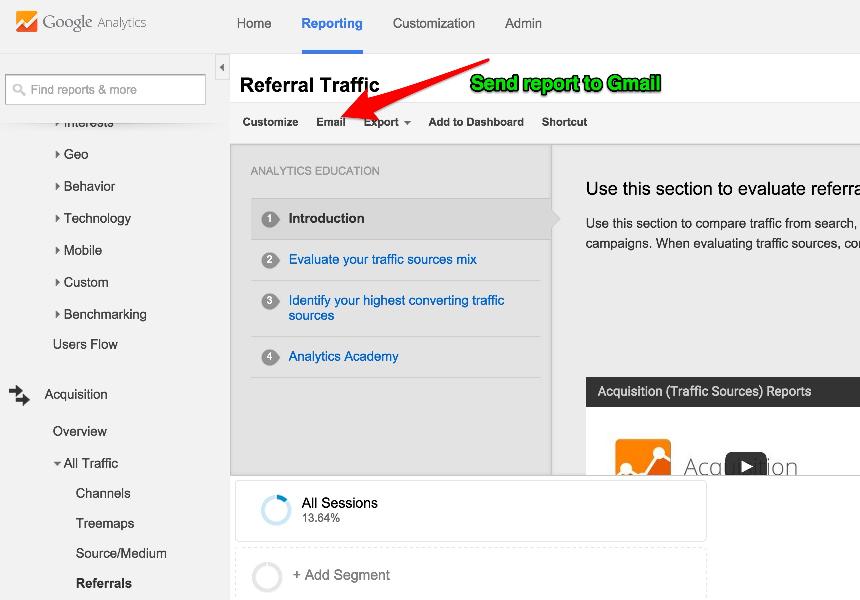

Analytic Tools

Analytic Tools

Marketing

Marketing

Site Ranking Stats

Site Ranking Stats

Keyword Ranking Position

Keyword Ranking Position

Keyword Difficulty Tool

Keyword Difficulty Tool

Site Security

Site Security

Editor's Tools

Editor's Tools